SEC Whistleblower FAQ

Are there protections from retaliation?

Yes. Section 922 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) added Section 21F to the Securities Exchange Act of 1934 (the “Exchange Act”), establishing the Commission’s whistleblower program.

The Dodd-Frank Act provides a whistleblower protection from retaliation:

No employer may discharge, demote, suspend, threaten, harass, directly or indirectly, or in any other manner discriminate against, a whistleblower in the terms and conditions of employment because of any lawful act done by the whistleblower.

How large is a whistleblower award?

Whistleblowers are eligible to receive as much as 30 percent of a recovery. The award ranges from 10-30 percent.

New SEC guidance is to assume that whistleblower should receive the maximum award of 30 percent for any award that will be below $5 million, assuming the whistleblower is not subject to any award reductions.

What are the SEC award reductions?

The SEC can reduce awards based on Rule 21F-6(b) of the Securities Exchange Act, if:

- the whistleblower has culpability in the scheme

- there was an unreasonable delay in reporting; or

- interference with an internal compliance and reporting system.

The most common reason for an award reduction is “unreasonable delay”. If you are aware of security violations or financial fraud, you should speak with an attorney as soon as possible.

Can I report anonymously?

Yes. You can report anonymously to the SEC.

Can I receive an award if I am anonymous?

Yes, but only if you are represented by an attorney. Without an attorney, you cannot both remain anonymous and complete the whistleblower rewards program claim process.

Can I receive an award if I am not an employee of the company?

Yes. You are not required to be an employee or an “insider” to have knowledge of security violations. 40% of SEC whistleblower awards are to those outside the scheme or company.

Can I receive an award if I am not an Unites States citizen?

Yes. You do not need to be a citizen of the United States to have knowledge of security violations affecting U.S. investors and to obtain a whistleblower award.

Does the violation have to occur in the United States?

No. The security law violation only needs to affect U.S. investors or U.S. markets. It does not matter if the act or those committing the violations are outside the United States.

What was the largest whistleblower award?

The largest whistleblower award to date was $114 million in November 2020. The whistleblower received two awards of $62 million and $52 million. Some whistleblower tips can result in multiple defendants and multiple actions resulting in sanctions, and the whistleblower can make a claim in each instance.

How much has the SEC awarded to whistleblowers?

The SEC has awarded over $600 million to whistleblowers to date, and the number increases each month. In November 2020, the SEC awarded $114 million to a single whistleblower.

Will I have to pay my whistleblower attorney up front or by the hour?

Schneider Wallace whistleblower attorneys are available on a contingency fee basis. The attorneys will work with you to assist you in your claim and the claim review, with only a portion of any whistleblower award as payment. You will not have to pay a retainer or pay ongoing costs. To speak with an experienced contingency whistleblower attorney, contact Schneider Wallace at 1-800-689-0024 or info@schneiderwallace.com.

Can I make a claim even if I was culpable in the security violation?

Yes. While being a part of any scheme can result in a reduced award, those who report wrongdoing to the SEC and assist in the prosecution of companies can receive an award even if they were a party to the violation. The SEC will investigate and determine culpability and the recommended award reduction. An attorney can help make the best claim possible and prepare requests for reconsideration.

Can I proceed with a qui tam lawsuit?

No. While whistleblowers are eligible for a portion of the sanctions award for their assistance in bringing the case forward, only the SEC can prosecute and collection sanctions. Unlike the False Claims Act, you cannot proceed without the government on their behalf. This type of lawsuit, proceeding on behalf of the government, is known as a qui tam lawsuit or a private right of action. To ensure the SEC understands the case and proceeds, you should work with an attorney to design the most compelling whistleblower report possible.

Do I have to be the first to report?

No. Unlike other whistleblower programs, such as the False Claims Act, a SEC Whistleblower Program claim need not be the first. It is also possible to receive an award even if an investigation has already begun from another tip. The requirement is that the information and assistance provided significantly helped the SEC in seeking sanctions.

Does the information have to be private?

No. Unlike the False Claims Act, public information can be used to determine wrongdoing. An example is a public dataset can be used for statistical analysis to determine fraud. This public information, combined with the analysis of the whistleblower, can form the basis of a whistleblower claim.

What are common types of SEC violations?

Common types of financial fraud include:

- Auditing and accounting misconduct

- False SEC reports and failure to file reports

- Insider trading

- Pyramid schemes

- Ponzi schemes

- Embezzlement, theft, or misappropriation of funds and securities

- Pump-and-dump schemes or other forms of market manipulation

- Unregistered or fraudulent securities offerings

- Foreign official bribery

- Municipal securities or public pension plan fraud

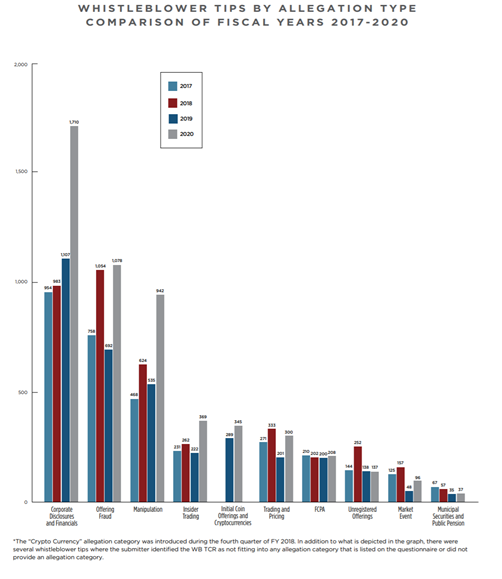

The SEC reports that the most common type of violation reported is in regard to corporate disclosures and financials. The second most common tip falls into the “offering fraud” category, with market manipulation as third most common. The SEC categorizes tips into categories. This is a chart of the tips received in each category for the last four years:

Do I need a SEC whistleblower attorney?

You can make a claim without an attorney. However, the SEC receives thousands of tips per year and has limited time and budget to investigate each tip. It is recommended that you work with an attorney to produce the best report to the SEC possible. You will also need an attorney if you wish to both remain anonymous and apply for a whistleblower reward.

To speak with a Schneider Wallace whistleblower attorney contact us at 1-800-689-0024 or info@schneiderwallace.com.